By Rachel Hu and Chris Garaffa - January 29, 2025 2

[Source: AP]

CLICK HERE to listen on podcast platforms worldwide https://linktr.ee/CovertActionBulletin

Support this broadcast: become a patreon!

After getting rain over the weekend, three of the main fires devastating the Los Angeles area are nearly 100% contained, meaning that firefighters have been able to create barriers around the fires. But the Palisades Fire, the Eaton fire and the Hughes fire continue to burn a combined nearly 48,000 acres of land. And to the south, just a few miles north of Tijuana Mexico, the Border 2 Fire has burned over 6,600 acres and is only 74% contained.

More than two dozen people have been killed as a result of the fires since they started in early January. Over 200,000 have been forced to evacuate, and tens of thousands of homes and businesses have been destroyed.

Rachel was in Los Angeles recently reporting on the fires, their causes, and the response of both the government and the people on the ground. While wildfires are often covered as only natural disasters and the victims of the fires are portrayed as helpless figures, the reality is much more damning for the capitalist system that refuses to take public safety, climate change and disaster recovery for working people seriously.

https://covertactionmagazine.com/2025/0 ... apitalism/

*****

Kelp Farming Isn’t As Green As It Seems

Posted on January 31, 2025 by Yves Smith

Yves here. I do try to keep up, but I must confess to not having heard of kelp cultivation as a carbon capture strategy. I had assumed the article would be about the merits of kelp and seaweed as highly nutritious foods versus their cost of cultivatiion compared to other health-enthusiast-preferred greens, notably kale and spinach (if you are from the South, you know that collard rates, as does chard). As one might infer, kelp for carbon capture doesn’t work so well unless it is interred in some fashion. It turns out that garden variety burial does not suffice. This piece explains why really getting kelp or any biomass out of the carbon cycle is not trivial.

By Veronique Carignan, an environmental chemist and former academic researcher in chemical oceanography. She now works as an environmental activist and freelance climate journalist. Originally published at Undark

Champions of the kelp industry have made bold claims that farming the fast-growing seaweed will alleviate the climate crisis. But those claims are not substantiated by the science of how kelp removes and sequesters atmospheric carbon. Kelp farming is a Band-Aid solution to mitigating global climate change, pushed to the forefront by decades of insufficiently modifying human behavior to cut carbon emissions.

Instead, the United States has focused its efforts on strategies that are largely centered around carbon capture, which removes carbon dioxide from the atmosphere and from emission point sources such as large industrial facilities and power plants. Most of these carbon capture strategies are costly, complex to implement, and not well studied, whereas kelp farming is cheap and technologically simple, making it an appealing option for those looking to use carbon capture as a climate change mitigation strategy.

Like almost all plants, kelp removes carbon dioxide from the atmosphere via photosynthesis. As one of the fastest growing organisms in the world (some species can grow up to 2 feet per day), kelp gains biomass quickly and thus sequesters carbon quickly. Natural kelp forests capture 5.4 million tons of carbon dioxide annually and are worth an estimated $500 billion, including their value in the food and materials industries. But even more money likely lies in the unexploited coastal ocean suitable for growing kelp, which spans an area of around 18 million square miles. Given the space available for aquaculture and the tremendous value of kelp, it is no surprise that seaweed is one of the fastest growing components of global food production, increasing on average 8 percent per year.

Companies seeking to capitalize on the obvious value of kelp farming are using its supposed carbon sequestration potential as a hook to expand the practice, raise funds, or sell carbon credits. However, scientists have questionedwhether kelp farming acts to store carbon long term. Although kelp does absorb carbon dioxide through photosynthesis, the long-term sequestration of that carbon is limited by a process called the slow carbon cycle.

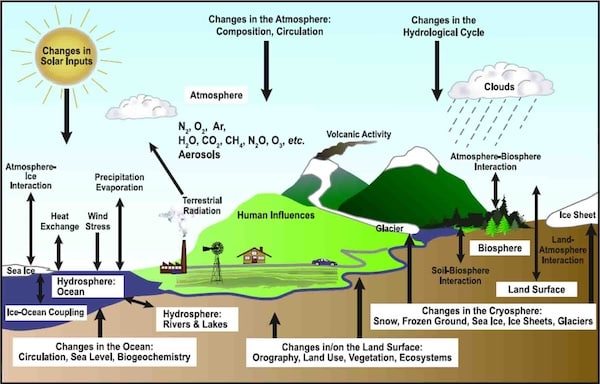

Global carbon cycling refers to the movement of carbon between the atmosphere, biosphere, ocean, and land. This cycling happens on two timescales: fast and slow. In the fast cycle, carbon is absorbed by plants and sequestered as organic matter. When plants die or are consumed (burned as biofuel, eaten, used as feed, or to make materials, for example), that carbon is usually released back into the atmosphere. This cycle takes years to decades and does not remove carbon from the atmosphere long term.

By contrast, the slow carbon cycle takes 100-200 million years and moves carbon from the atmosphere to rock material and fossil fuels. Carbon moved via the slow carbon cycle is considered truly “removed.” Note that burning fossil fuels (that is, roughly 300-million-year-old carbon) has been adding billions of tons of carbon dioxide annually to natural emissions from the respiration of organisms, disrupting the slow carbon cycle. That is why human perturbations to the carbon cycle have such dire and permanent consequences for the planet.

For kelp to be useful in storing carbon, it needs to be stored as part of the slow carbon cycle, which means kelp needs to be deposited in the deep ocean where it won’t interact with the atmosphere for centuries to millennia. That doesn’t happen if the kelp is being used as food, a biofuel, or in materials production because all those pathways lead to the carbon dioxide being emitted back to the atmosphere via the fast carbon cycle.

To solve this issue, some companies plan or purport to deliberately sink seaweed, thereby enhancing its long-term storage capacity. Then, they profit from this sequestration by selling carbon credits to companies with large carbon emissions. The repercussions of sinking millions of tons of kelp to the seafloor are unknown, but changing the nutrient balance of the deep sea is dangerous because organisms living there can be particularly vulnerable to shifts in things like pH and oxygen availability. What’s more, the technology required to achieve this will likely involve using fossil fuels. In fact, the potential environmental outlook for sinking seaweed is so bad that some scientists have called for a moratorium on the practice, but companies are charging ahead anyway.

For example, Maine-based Running Tide Technologies was the one of the world’s largest kelp-based carbon removal startups but failed to deliver on its promises, going out of business in 2024, only seven years after being founded. Running Tide raised $54 million in funding to grow kelp on flotation devices designed to sink to the deep ocean. When its plan became too costly and its proof of concept failed, the company instead sunk some 21,000 tons of wood chipsoff the coast of Iceland to fulfill the carbon credit promises it sold to large corporations, including Microsoft and Shopify.

Even if we ignore the many pitfalls and unknowns of farming kelp for carbon sequestration, we would need an enormous amount of space to sequester just a fraction of the carbon dioxide emitted each year. One analysis calculated that 300-foot-wide kelp farms running along 63 percent of all global coastlines would be needed to sequester 0.1 billion tons of carbon dioxide per year — a mere 2 percent of annual U.S. emissions.

Some supporters of kelp farming suggest that kelp should not be sunk but rather used to replace fossil-fuel dependent systems. There is potential in using kelp biofuel or kelp-based animal feed to reduce carbon emissions. However, farming kelp on a large scale for such purposes would have negative repercussions on ocean ecosystems and could actually exacerbate climate change. Shading from kelp reduces phytoplankton growth, which could reduce the efficiency of sinking kelp for carbon sequestration by 37 percent. Adding massive amounts of organic carbon to the deep ocean would deplete oxygen, shifting the nutrient balance of the deep ocean and of upwelling regions which supply global ocean fisheries. When kelp grows, it emits halocarbons, which are short-lived but highly potent greenhouse gases. Kelp farming is far from a green solution and puts our oceans at further risk of deterioration.

Ocean governance is notoriously relaxed and difficult to enforce, but the ocean is the primary regulator of the Earth’s climate. It is imperative that we take caution before undertaking global-scale modifications to the ocean’s delicate balance. Ultimately, efforts placed into changing human behavior and developing technologies to disentangle our global systems from their reliance on fossil fuels are far more valuable than working on temporary strategies that allow us to continue business as usual.

https://www.nakedcapitalism.com/2025/01 ... seems.html

******

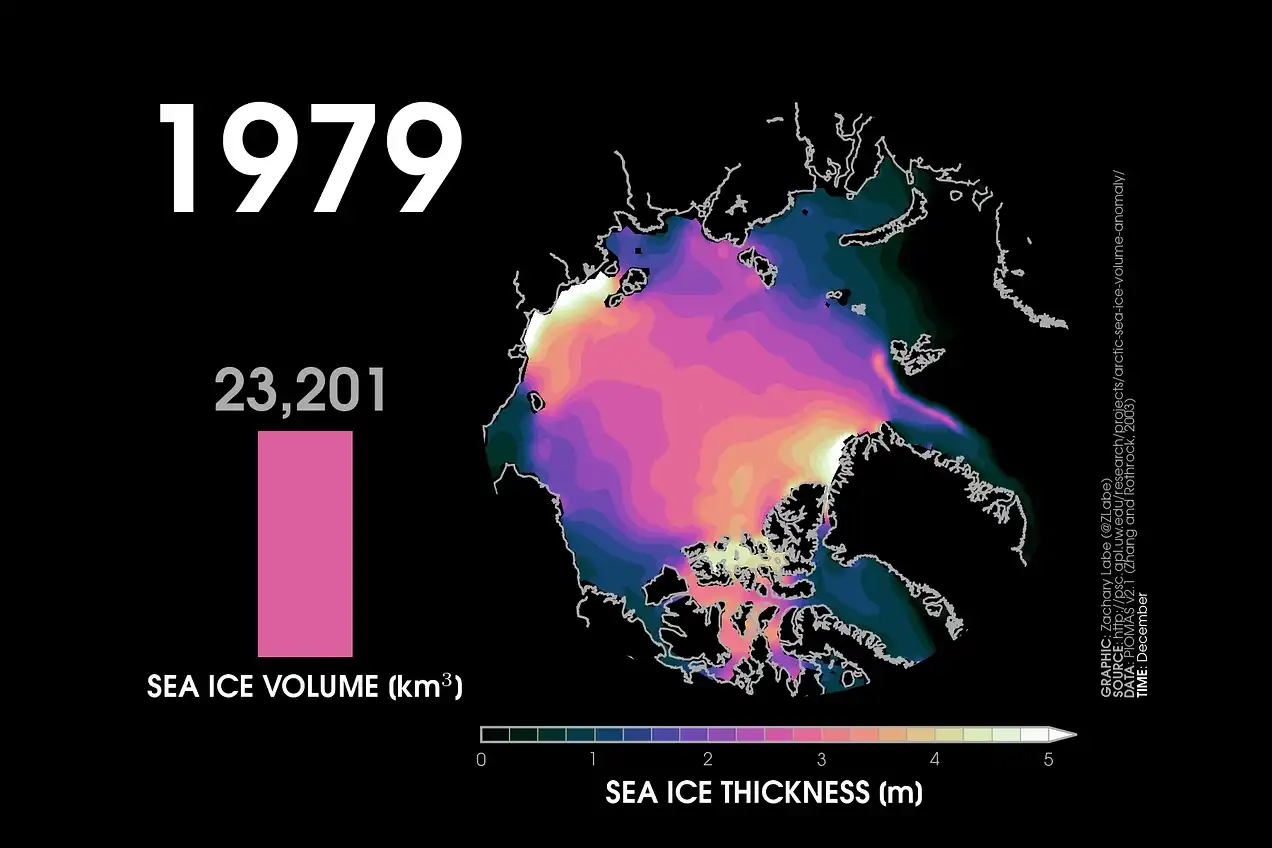

Climate Change Sacrifice Zones

Roger Boyd

Feb 01, 2025

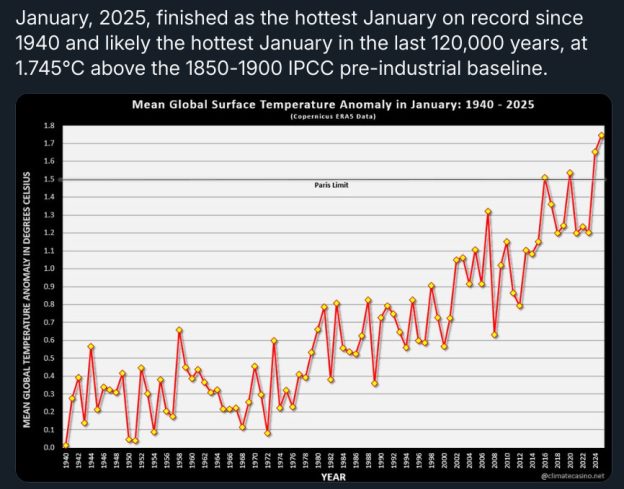

With the election of Donald Trump it is inevitable that no holistic action plan will be put in place to deal with the impacts of climate change by the United States government for at least the next four years. Instead, each new catastrophe will be dealt with as a standalone crisis; quickly to be forgotten as the media moves on. Adaptation will be left to the market. The new president may visit the disaster zones, such as North Carolina (flooding) and Los Angeles (fires) but will never accept that the scale of the disasters was influenced by climate change. Those influences include:

The warmer air is, the more moisture it can hold, leading to more intense downpours.

The warmer air is, the more it can suck the moisture out of the ground and vegetation, creating conditions conducive to more rapid spreads, and greater intensity, of wildfires.

The warmer the oceans are, the more intense will be the storms that build their strength above those waters.

Breakdowns in the polar jet stream create incursions of Arctic air south, together with weather blocking patterns.

Glacier melt and the possible backing up of the Gulf Stream current will combine with land subsidence to create increasing levels of flooding along the coast of Florida and the US east coast in general.

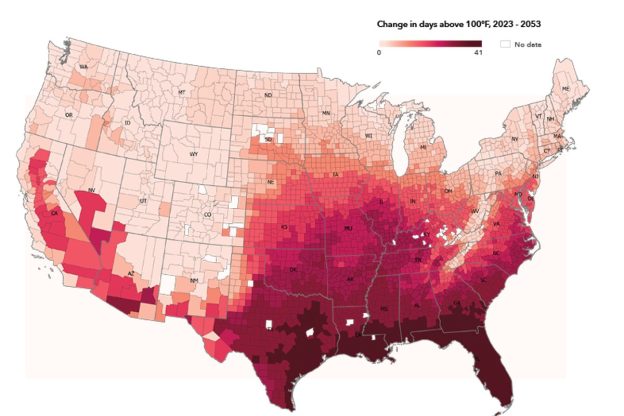

Whether it be Atlantic hurricanes, wild fires, snow in Texas or regional flooding, weather-related events are becoming much more intense and frequent. As we have seen in Los Angeles, the response of the insurance companies will be to either remove coverage for natural disasters or to increase the price of that coverage beyond a point that many can afford. The losses will then be substantially born by the victims who may become bankrupted or greatly financially depleted. At the same time, financial institutions will not provide property loans for properties that cannot be insured. We must remember that the L.A. fires are occurring in a time of year that is outside the usual fire season, so the current fires may only be the start of a whole year of such catastrophic fires. With those fires rapidly spreading to large areas covered by bone dry flora. In addition, the fire-denuded hill sides will increase the risk of landslides and flooding.

With the cost of wild fires increasing over time, insurance companies had already been repricing and reducing their insurance coverage in the area. Many homeowners were not insured against such fires, with high risk areas becoming less and less tenable to insure. Even those insured may be faced with insurers working hard to find any way to reduce their payouts.

In California the FAIR state insurance is available, but the premiums are higher and the coverage is less. In addition, it may be under-reserved resulting in the state having to cover some of the payouts. As climate change intensifies, will the state still be willing to fund the insurance shortfalls or will increasing areas become uninsured sacrifice zones?

Many states have their own fallback flood insurance for people who cannot afford private flood insurance, and there is also the federal National Flood Insurance Program (NFIP) that covers about 5 million households in known flood plains mostly in Texas and Florida where private insurance is not available. Raising the NFIP insurance rates to cover increased levels of risk is a hot political issue, as it could have very significant economic impacts within Texas and Florida; both of which have large populations that are represented in Congress. A previous attempt to raise rates was defeated and the NFIP program remains grossly underfunded.

In Florida the state flood insurer is the Citizens Property Insurance Group which limits coverage to homes costing up to $700,000 ($1 million in Miami-Dade and Monroe counties) where private insurance premiums are more than 20% higher than the Citizen’s policy. Home insurance in Florida is approximately four times more expensive than the national average. The risk with such state insurance is that as private insurers raise premiums higher and higher the state insurer increasingly becomes the only insurer, with the state at risk of having to cover a huge financial liability.

Such state back stop insurance also acts as an inducement to people to rebuild in areas prone to disasters that are increasing in both frequency and intensity over time; a strategic misallocation of resources. At the same time, it supports the continued increase in the Floridian population - something the state fully supports. The US population is continuing to increasingly move to areas that are most at risk from climate change, as disasters are quickly forgotten and populations habituate to a new normal.

In Florida, the situation is made worse by land subsidence which magnifies sea level rise, especially in the barrier islands upon which so much expensive real estate sits (its also a big problem for the whole of the Gulf Coast, but there is much less very expensive real estate there). As you can see below, interested parties such as property developers will do their utmost to bad mouth any analyses that put their investments and profits at risk.

Add to that rising groundwater levels as the rising sea pushes inland through a Florida that is a porous flat plateau of limestone. Fundamentally, Florida and other flood prone areas are in a property bubble that interested parties will work very hard to keep inflated until they no longer can. Nothing has changed since the documentary below was made eight years ago, including the ad hoc responses and lack of a long term plan.

A more recent coverage of the state of play in Florida and the lack of strategic planning and holistic action. Even some more incremental proposed actions, such as a 10 km flood barrier have met great resistance. More like “build baby build” in a long-term doomed area.

The results of sea level rise and land subsidence are already being seen as increasing flooding from high king tides.

As shown in the above, cities are dealing incrementally with the issue but not strategically re-examining their development plans. Let’s remember that the governor of the state of Florida is a climate denier and will not allow for such discussions to enter the political realm. Each year the risks of a catastrophic event, or combination of events, that will bankrupt the state treasury increases and each year Florida sees if it once again will dodge the climate bullet or bullets. All the while, insurance rates will continue upwards and more restrictive clauses added to policies.

Societal collapses tend not to occur in a sudden or linear fashion, but rather through a series of catastrophes interspersed with periods of relative stability. Florida is one bad year away from a fundamental reappraisal of the viability of many of its major population areas. If the state insurer exhausts its reserves it can borrow from the state government and place a surcharge on all insurance policies across the state, but both actions would tend to harm the economy through raised taxes/cuts in other areas of government spending and even higher insurance rates. And that is if the state could take on the scale of the outstanding state insurer liabilities. Would the federal government bail the state out if it could not?

Florida is a very special case, as its limestone base will allow flood water to flow underneath any flood barriers and invade clean water sources. The reality is that Southern Florida is non-tenable in a climate changed world, but politics and vested interests will block any rational evacuation form these areas. Instead that evacuation will be carried out in painful steps, with large amounts of money and resources spent on rebuilding and incrementally protecting non-viable areas. With each catastrophe dealt with as a standalone event, followed by a new economic equilibrium low until the next event arrives. Losses will be spread extremely haphazardly across home owners, the state (which is funded by the overall population of Florida) and insurance companies. Australia, with its climate-denial government fully dominated by fossil fuel and mining interests, is going through exactly the same process.

The same for Porto Alegre, in one of the wealthiest areas of Brazil in the south of the country. Over half a million people have been displaced and many will quite possibly never return. Whole neighbourhoods have been defined as sacrifice zones by the state, where infrastructure will not be rebuilt. The area affected accounts for 6% of national GDP and will be a massive financial challenge for the state to fund the rebuilding.

Insurance companies use reinsurers to offload the risks of the most extreme events, as bookies do with other bookies, but that can lead to a concentration of reinsurance risk within a few reinsurers without adequate capital to cover claims; akin to what happened with AIG and credit insurance during the Global Financial Crisis (GFC). 2023 was the fourth year in a row that insured catastrophe losses exceeded US$100 billion and it looks as if 2024 will continue that trend; well above the 10-year average of US$37 billion. Reinsurers have responded by repricing risk upwards, and have

become more averse to backstopping “secondary perils,” which are smaller but more frequent extreme weather events such as tornadoes, thunderstorms, fires and floods. These localized events are harder for the insurance industry to model and manage, partly because they’re driven by climate change.

They’re also responsible for a rising share of insured losses. Severe convective storms alone accounted for about $70 billion of insured losses globally last year, according to an estimate by insurance broker Aon Plc. That’s equivalent to 59% of losses from all natural disasters.

This forces more of the risk back onto the primary insurers:

By 2023, “a large portion of the losses fell mainly on primary insurers,” particularly in the US where most severe convective storms occur, according to S&P. Conversely, reinsurance losses were “well within their budgeted natural-catastrophe load.”

This is a very good article on Naked Capitalism about the escalating levels of climate-driven catastrophic events. It states that there were “58 billion-dollar weather disasters in 2024, ranking second-highest behind only 2023, which had 73”. The reinsurers are reacting incrementally to the increased risks that they have observed by taking on less of the risk, raising prices and putting more restrictive clauses into policies. But this does not take into account that climate change is continuing, and may very well be accelerating. The capital of the insurers and reinsurers is sized looking in the rear view mirror and extrapolating, just like those “capital at risk” models that completely failed during the GFC. Property insurance and reinsurance is a financial accident waiting to happen, dependent on the vagaries of the weather, climate change and the paths of individual storms, floods and fires.

For example, “100 year flood events” are happening in some places now every eight years - overwhelming the sewer systems and causing widespread damage.

The reserves of the primary insurance companies and reinsurers are generally held in government bonds as they are assumed to be both safe from default and easily sold in a liquid market. In a year of exceedingly high catastrophic losses both groups of insurers would be selling significant amounts of those bond portfolios to cover payouts, and concerns about their solvency may greatly limit their ability to borrow funds. As many of these companies are also big players in global derivative markets there is the possibility of another GFC being triggered. Even if a GFC is not triggered there may be a fundamental rethink of property insurance that would have global scale impacts. A major non-linear change in the cost and availability of insurance that could affect property prices across whole cities and regions, with Florida as one of the regions at the epicentre of such property reevaluations.

Fundamentally “leaving it to the market” and adaptation is not a viable solution for climate change, which instead calls out for holistic federal level strategic planning. But that will not be in place for at least the next four years in the US, and quite possibly much longer than that. This article in The Guardian makes an utterly ridiculous claim:

It obviously isn’t realistic to imagine that the entire population of somewhere like Los Angeles could up sticks and recreate the city somewhere safer, which means that a viable insurance industry is a non-negotiable; but if the world in 2050 looks very different to the one of 2000, it may not make sense to create incentives for people to live in places that are becoming much more dangerous.

Available insurance is not a right, and as losses continue to escalate they will overwhelm the ability of insurance companies to cover and the state to backstop. Whole areas will end up with no coverage for climate-related hazards, as happened for many LA residents prior to the most recent fires. The problem cannot be fixed by “the market” it requires a whole of society model with rational forward looking government policies; an approach very unlikely to be followed in the deeply neoliberal United States. Instead, areas where insurance becomes unavailable will see declining house prices with millions of people defaulting on their mortgages; another possible trigger for a new GFC. A reversal of the US population movements of the past decades may also be triggered, with large numbers of people and businesses moving back toward the less exposed northern states.

States with highly competent and non-corrupt officials will tend to manage such issues in a much more effective and efficient way, wasting many less resources and managing the required infrastructure development and population movements. Here, once again, China possesses a huge advantage over the US and other Western countries. For example, redesigning cities to allow them to be much more resistant to flooding:

It also has both much greater engineering project efficiency and effectiveness, and state legitimacy than Western nations; especially a US which could descend into project profiteering, delays and political deadlock while hamstrung by neoliberal ideology.

In the US, the sacrifice zones will be slowly and painfully given up with large amounts of money and resources spent on doomed rebuilding and incremental fixes. With individual financial outcomes dependent on sheer chance as much as savvy planning. Many will lose much, if not all, of their assets; as is being seen with the LA fires. President Trump has promised a rapid rebuilding in North Carolina after the flooding, but in the long-term will those rebuilt properties simply be flooded out again?

There will come a day when the US state decides to no longer provide the backstop insurance and to not fund rebuilding. Such a response would produce a major repricing of properties within the sacrifice zones. But not before huge amounts of wasted rebuilding, wasted insurance payouts and wasted state rescues. Countries like China will waste many less resources, and experience less losses, due to their much more sound planning and adaptive actions.

https://rogerboyd.substack.com/p/climat ... fice-zones